Articles, Guides, and Advice from The Dorazio Real Estate Team

Understanding the Differences Between Base Housing and Civilian Housing

Deciding between base housing and civilian housing is crucial for military families, as each option offers distinct benefits and challenges. Explore the key differences in cost, location, space, and community to make the best choice for your family’s needs and lifestyle.

How to Prepare Your Home for Rent or Sale During a PCS Move

Preparing your home for rent or sale during a PCS move requires strategic planning and attention to detail to ensure a smooth transition and successful transaction. By decluttering, making necessary repairs, and enhancing curb appeal, you can significantly increase your property’s appeal to potential buyers or renters, leading to a quicker and more profitable outcome.

Strategies for Buying Property in High-Demand Markets as a Military Family

Navigating high-demand real estate markets can be especially challenging for military families facing frequent relocations. With the right strategies, like working with the veteran-led team at Dorazio Real Estate and being prepared to act quickly, you can successfully secure the right property even in competitive environments.

How to Successfully Navigate Real Estate Transactions While Balancing Military Duties

Navigating real estate transactions while managing military duties and frequent relocations can be challenging. This guide offers essential tips, including leveraging technology and clear communication with experienced agents, to ensure a smooth and successful transition for military members buying or selling homes.

The Importance of Home Ownership in Building Wealth for Veterans

Homeownership is a cornerstone of financial stability and wealth building, especially for veterans. It not only provides a place to live but also offers significant long-term financial benefits through equity growth, appreciation, and generational wealth transfer.

Tips for Veterans on Keeping Utility Costs Low

Veterans on fixed incomes can manage utility costs by conducting energy audits, improving insulation, optimizing heating and cooling, upgrading appliances, and adopting energy-saving habits. Implementing these tips can lower utility bills and enhance home energy efficiency.

Tips for Veterans Transitioning to Civilian Life and Homeownership

Transitioning from military service to civilian life can be challenging, especially when it comes to achieving homeownership. This guide provides valuable tips for veterans on financial planning, building a support network, understanding mortgage options, and navigating the home buying process.

Tips for Veterans Moving to a New City

Military life often involves frequent relocations, which can significantly impact homeownership. Understanding how to manage these moves is essential for military families looking to buy or sell homes. By researching new cities, budgeting for moving expenses, and staying connected with veteran communities, military families can make their transitions smoother and enjoy their new surroundings.

How to Use VA Housing Grants for Disabled Veterans

The Department of Veterans Affairs (VA) offers several housing grants to help disabled veterans modify their homes for better accessibility and comfort. These grants, such as the Specially Adapted Housing (SAH) Grant, Special Home Adaptation (SHA) Grant, and Temporary Residence Adaptation (TRA) Grant, cater to different needs and situations. The veteran-led team at Dorazio Real Estate can assist veterans throughout the application process, ensuring all necessary documentation is gathered and forms are completed accurately for a successful submission.

From Dream to Reality: How I Helped a Veteran Client buy a 4-Flat with Zero Dollars in Out-of-Pocket Expenses

Discover how I helped an Air Force veteran buy a $965k 4-flat in Chicago with zero out-of-pocket expenses using a VA loan. This journey involved overcoming unexpected challenges and highlighted the importance of having a knowledgeable team experienced in VA loans and multifamily investments. Learn how strategic planning and thorough due diligence can unlock incredible wealth-building opportunities for veterans.

Buying a Home Near a Military Base: Pros and Cons

Buying a home near a military base offers both advantages and challenges for military families. Benefits include shorter commutes, strong community support, and access to base amenities. However, potential drawbacks include noise, frequent relocations, and higher property prices. Families should carefully weigh these factors against their needs and long-term plans when making a decision.

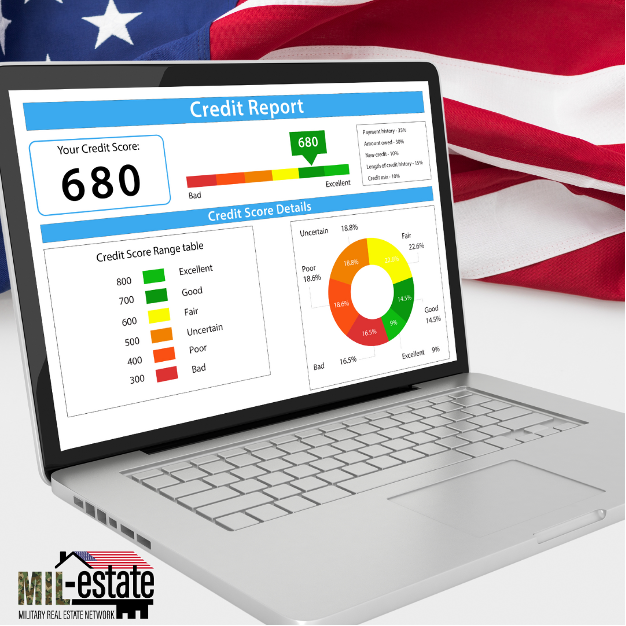

How to Improve Your Credit Score for a VA Loan

Boost your chances of securing a VA loan with favorable terms by improving your credit score. Learn practical steps like checking your credit report for errors, paying down debt, and making timely payments to enhance your financial health and increase your loan approval odds.

The Impact of Military Relocation on Homeownership

Military relocations present unique challenges for homeownership, such as difficulty in building home equity and settling in a community. Choosing the right location, utilizing VA loan benefits, and deciding between renting or buying are crucial steps for military families. Dorazio Real Estate, a veteran-led company with significant experience, can assist you in navigating these complexities and making informed decisions about your home.

How to Get Pre-Approved for a VA Loan: Tips and Tricks

Pre-approval for a VA loan is a crucial step for veterans and active-duty service members looking to buy a home, offering benefits like no down payment and competitive interest rates. Ensure you meet eligibility requirements, check your credit score, gather necessary financial documents, choose a VA-approved lender, and maintain financial stability throughout the process to secure your pre-approval smoothly. Dorazio Real Estate, being veteran-led and experienced with VA loan products, can guide you through each step to ensure a successful pre-approval and home buying experience.

11 Things I Wish I Knew When I Was 22 And Getting Started In Real Estate

Discover the 11 essential lessons I wish I knew when I started investing in real estate at 22. From leveraging loans and finding mentors to focusing on strengths and understanding taxes, these insights will help you avoid common mistakes and fast-track your success. Click to learn how to shape your future one property at a time!

Unlocking the Benefits: Understanding VA Assumable Loans

Unlock the benefits of VA assumable loans for affordable homeownership with this comprehensive guide. Learn how military borrowers and beyond can take advantage of lower interest rates and streamlined processes.

The Military Homebuyer’s Guide: Navigating the Path to Homeownership

Navigating homeownership as a military member involves unique challenges like frequent relocations and specialized financing options. This guide offers strategic steps and military-specific resources to help service members, veterans, and their families confidently achieve their homeownership goals.

Embracing Simplicity: Exploring Tiny Home Living for Veterans

Unlock the secret to affordable, sustainable housing for veterans with Dorazio Real Estate and the MIL-Estate network. Discover how tiny homes are revolutionizing post-military life

Sewer Scopes: A Wise Investment for Chicago homeowners and investors

Considering buying a home or investment property in Chicago? A sewer scope inspection could save you thousands of dollars down the road. This quick and painless procedure reveals hidden problems in your main sewer line, giving you valuable insight before you buy.

Tips for Military Families Buying Homes with Multi-Generational Living Spaces

Military families seeking a home for multi-generational living should prioritize properties with separate living areas, flexible floor plans, and accessibility features. Partner with a knowledgeable real estate agent, like the ones at Dorazio Real Estate, who understand these unique needs and can help navigate legalities and finances for a smooth multi-generational home-buying experience.