Articles, Guides, and Advice from The Dorazio Real Estate Team

The Importance of Home Ownership in Building Wealth for Veterans

Homeownership is a cornerstone of financial stability and wealth building, especially for veterans. It not only provides a place to live but also offers significant long-term financial benefits through equity growth, appreciation, and generational wealth transfer.

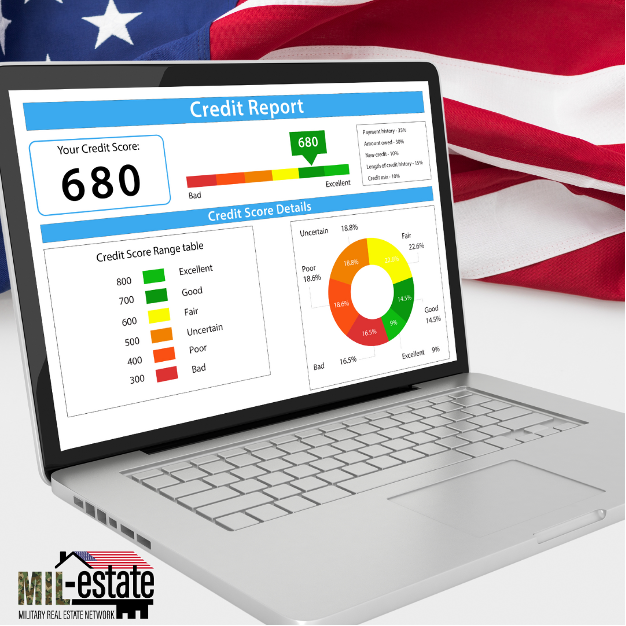

How to Improve Your Credit Score for a VA Loan

Boost your chances of securing a VA loan with favorable terms by improving your credit score. Learn practical steps like checking your credit report for errors, paying down debt, and making timely payments to enhance your financial health and increase your loan approval odds.

The Impact of Military Relocation on Homeownership

Military relocations present unique challenges for homeownership, such as difficulty in building home equity and settling in a community. Choosing the right location, utilizing VA loan benefits, and deciding between renting or buying are crucial steps for military families. Dorazio Real Estate, a veteran-led company with significant experience, can assist you in navigating these complexities and making informed decisions about your home.

How to Get Pre-Approved for a VA Loan: Tips and Tricks

Pre-approval for a VA loan is a crucial step for veterans and active-duty service members looking to buy a home, offering benefits like no down payment and competitive interest rates. Ensure you meet eligibility requirements, check your credit score, gather necessary financial documents, choose a VA-approved lender, and maintain financial stability throughout the process to secure your pre-approval smoothly. Dorazio Real Estate, being veteran-led and experienced with VA loan products, can guide you through each step to ensure a successful pre-approval and home buying experience.

Unlocking the Benefits: Understanding VA Assumable Loans

Unlock the benefits of VA assumable loans for affordable homeownership with this comprehensive guide. Learn how military borrowers and beyond can take advantage of lower interest rates and streamlined processes.

8 Home Loan Myths vs. Facts: Separating Truth from Fiction

Buying a home is a significant financial decision, and navigating the world of mortgages can be daunting. With so much information available, it's essential to distinguish between myths and facts when it comes to home loans. In this blog, we'll debunk common home loan myths and provide you with the facts you need to make informed decisions.

Making the Most of Your Military Housing Allowance: 7 Steps to Buying Smart

For military service members, navigating the real estate market can be both exciting and challenging. One of the significant advantages you have at your disposal is the Military Housing Allowance (Housing Allowance), which can play a crucial role in your homeownership journey. In this blog, we will discuss how you can maximize your Housing Allowance and make smart decisions when buying a home.